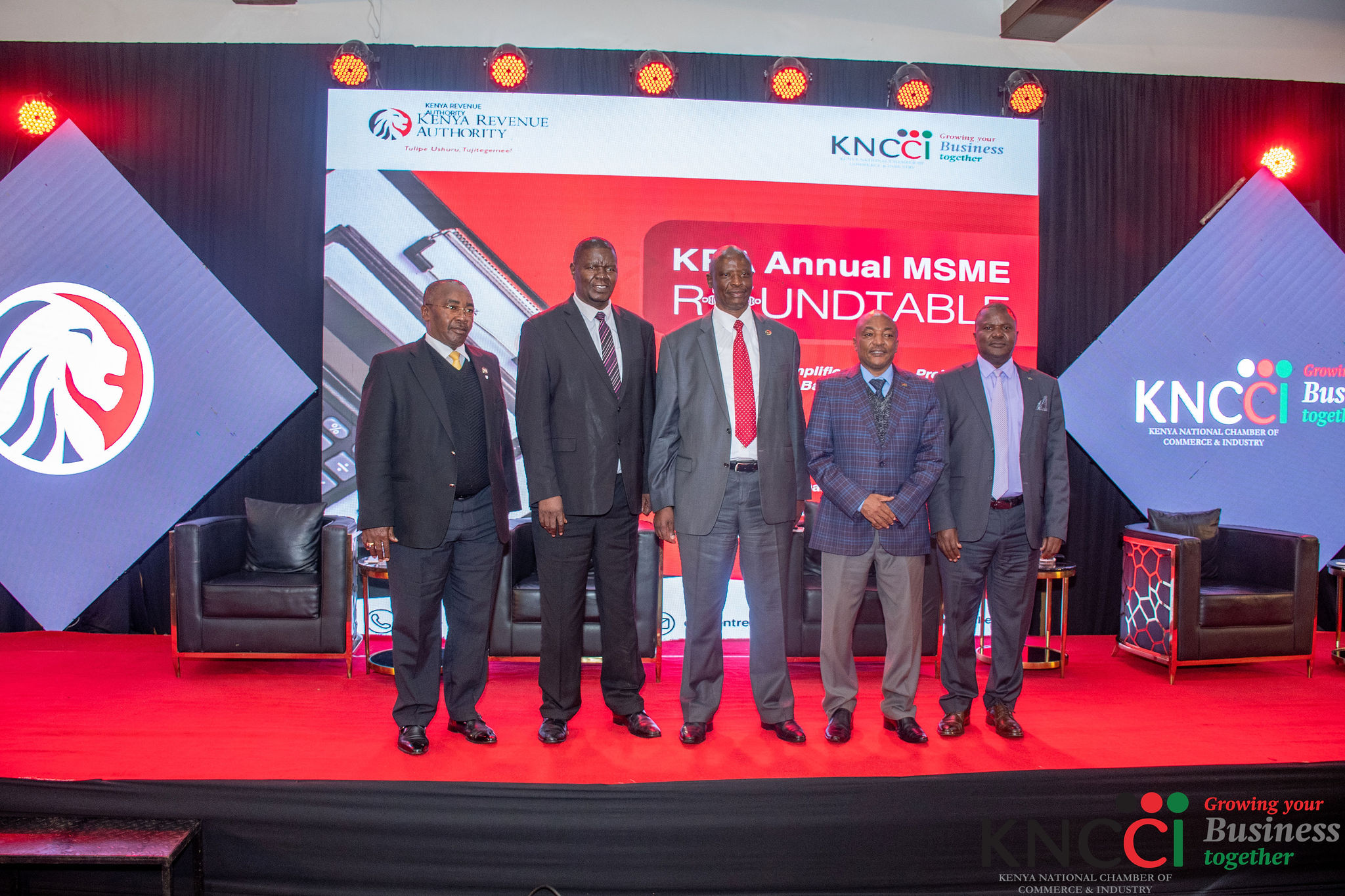

In order to improve on stakeholder management, which is key in building trust in the drive to promote voluntary tax compliance, The Kenya National Chamber of Commerce & Industry (KNCCI) in collaboration with the Kenya Revenue (KRA) this morning had a consultative dialogue meeting with different key players and the business community at Times Towers , Convention Centre.

Kenya’s Micro, Small and Medium Enterprises (MSMEs) contribute approximately 40% of the GDP with the majority falling in the informal sector.

The main aim of the roundtable was to get to understand the challenges faced by the SMEs with a view of resolving the challenges that may hamper the ease of doing business.

The roundtable comprised of a panel discussion, which comprised of the following panelists from both the private and public sectors;

- Maurice Oray (Deputy Commissioner, Corporate Policy Unit)

- Patrick Nyangweso- CEO KNCCI

- James Mureu – Board Chairman ,Micro and Small Enterprise Authority (MSEA)

- Richard Muteti- CEO Kenya National Federation of Jua Kali Associations

KNCCI CEO Mr. Patrick Nyangweso was steadfast in calling for tax education among citizens outside of major economic hubs and across all counties paying attention to counties that are engaged in cross boarder trade.He emphasized that tax education at the grassroot level is the key to expanding the tax base. Educating business owners on the importance of taxes, the benefits of compliance, and the penalties for non-compliance can encourage more businesses to register and pay taxes.

Mr Muteti, CEO Kenya National Federation of Jua Kali Associations, asserted that tax education should be two-way and challenged KRA to get to know its tax base better by simplifying tax procedures and making them more accessible can encourage informal businesses to register and pay taxes.

Board Chairman MSEA Mr. James Mureu encouraged KRA to apply soft diplomacy and an open-door policy from KRA would go a long way in incentivizing voluntary tax compliance from citizens. Governments can offer incentives to informal businesses to encourage them to comply with tax laws. For example, tax breaks, subsidies, could be offered to businesses that register and pay their taxes.

Engaging the informal sector for tax purposes requires a couple of approaches such as simplification of procedures, incentives, education, collaboration, technology, and flexible payment options.

Dialogue enables MSMEs to build relationships with stakeholders, including customers, suppliers, government agencies, and other businesses. The Kenya Revenue Authority gave their commitment to have sessions to sensitize the publics and MSMEs for tax base expansion.

Leave A Comment