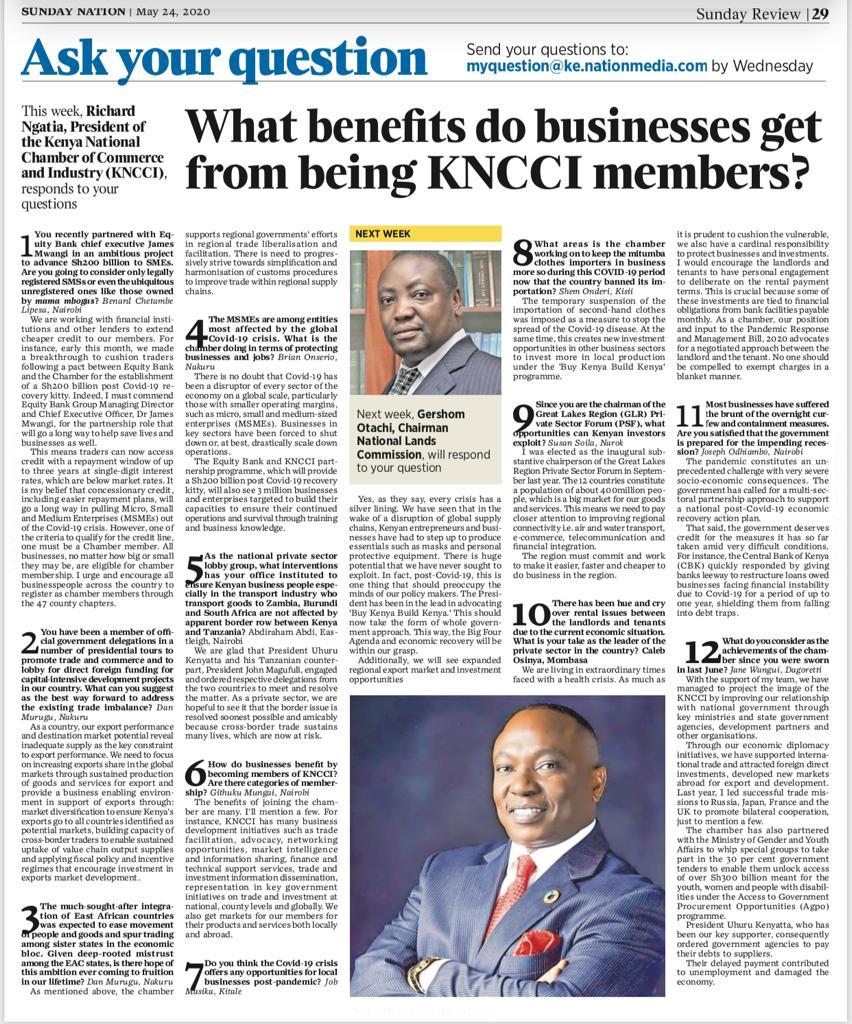

SUNDAY NATION Q & A

- Q: The Micro, Small and Medium Enterprises (MSMEs) has been one of the most affected by the global Covid-19 crisis, what is the chamber doing in terms of protecting businesses and jobs?

Brian Onserio, Nakuru.

There is no doubt that Covid-19 has been a disruptor of every sector of the economy on a global scale, particularly those with smaller operating margins, such as micro, small, and medium-sized enterprises (MSMEs). Businesses in key sectors have been forced to shut down or, at best, drastically scale down operations.

The Equity Bank and Chamber partnership programme to provide a Sh200billion post Covid-19 recovery kitty will also see 3 million businesses and enterprise targeted to build their capacities to ensure their continued operations and survival through training and business knowledge.

- Q: Most businesses have suffered the brunt of the overnight curfew and containment measures. Are you satisfied that the government is prepared for the impending recession?

Joseph Odhiambo, Nairobi

The pandemic constitutes an unprecedented challenge with very severe socio-economic consequences. The government has called for a multi-sectoral partnership approach to support a national post COVID-19 economic recovery measures and action plan.

That said, the government deserve credit for the tangible measures it has so far taken amid very difficult conditions. For instance, the Central Bank of Kenya (CBK) quickly responded by giving banks leeway to restructure loans owed businesses facing financial instability due to Covid-19 for a period of up to one year shielding them from falling into debt traps.

- Q: Do you think the Covid-19 crisis offers any opportunities for local businesses post-pandemic?

Job Masika, Kitale.

Yes, as they say, every crisis has a silver lining. We have seen that in the wake of a disruption of global supply chains, Kenyan entrepreneurs and businesses have had to step up to produce essentials such as masks and personal protective equipment. There is huge potential that we have never sought to exploit. In fact, post-Covid-19, this is one thing that should occupy the minds of our policy makers. The President has been in the lead in advocating ‘Buy Kenya Build Kenya.’ This should now take the form of whole government approach. This way, the Big Four Agenda and economic recovery will be within our grasp.

Additionally, we will see expanded regional export market and investment opportunities

- You recently partnered with Equity Bank CEO James Mwangi in an ambitious project to advance Sh200 billion to cushion SMEs. Are you going to consider only legally registered SMSs or even the ubiquitous unregistered ones like those owned by mama mbogas?

Benard Chetambe Lipesa, Nairobi

We are working with financial institutions and other lenders to avail cheaper credit to our members. For instance, early this month, we made a breakthrough to cushion traders following a pact between Equity Bank and the Chamber for the establishment of a Sh200 billion-Post Covid-19 recovery kitty. Indeed, I must commend Equity Bank Group Managing Director and Chief Executive Officer Dr James Mwangi for the partnering role that will go a long way to help save lives and businesses as well.

This means that traders can now access credit with a repayment window period of up to three years with single-digit interest rates which are below market rates. It is my belief that affording concessionary credit, including easier repayment plans will go a long way in pulling MSMEs out of the Covid-19 crisis. However, one of the criteria to qualify for the credit line, one must be a chamber member. All business no matter how big or small they may be are all eligible for chamber membership. I urge and encourage all businesspeople across the country to register as chamber members through the 47 county chapters.

- Q: As the national private sector lobby group, what interventions has your office instituted to ensure Kenyan business people especially in the transport industry who transport goods to Zambia, Burundi and South Africa are not affected by apparent border row between Kenya and Tanzania?

Abdiraham Abdi, Eastleigh, Nairobi

We are glad that His Excellency President Uhuru Kenyatta and his Tanzanian His Excellency John Magufuli engaged and ordered respective delegations from the two countries to meet and resolve the matter. As a private sector, we are hopeful to see it that the border issue is resolved soonest possible and amicably because cross border trade sustains many lives, which are now at risk.

- You have been a member of official government delegations in a number of presidential tours to promote trade and commerce and too lobby for direct foreign funding for capital intensive development projects in our country. What can you suggest as the best way forward to address the existing trade imbalance?

Dan Murugu, Nakuru

As a country, our export performance and destination market potential reveal inadequate supply as the key constraint to export performance. We need to focus on increasing exports share in the global markets through sustained production of goods and services for export and provide a business enabling environment in support of exports through; market diversification to ensure Kenyan exports go to all countries identified as potential markets, building capacity of cross border traders to enable sustained uptake of value chain output supplies and applying fiscal policies and incentives regimes that encourage investment in exports market development.

- The much sought-after integration of East African countries was expected to ease the movement of people and goods in a manner to spur trading between our sister states in this economic block. Given deep rooted distrust among the EAC states, is there hope of this ambition ever coming to fruition in our lifetime?

Dan Murugu, Nakuru

As mentioned above, the chamber support regional governments’ efforts in regional trade liberalization and facilitation. There is need to progressively strive towards simplification and harmonization of customs procedures to improve trade within regional supply chains.

- Since you are the chairman of the Great Lakes Region (GLR) Private Sector Forum (PSF), what opportunities can Kenyan investors exploit?

Susan Soila, Narok

I was elected as the inaugural substantive chairperson of the Great Lakes Region Private Sector Forum in September last year. The twelve countries constitute a population of about 400million people which is a big market for our goods and services. This means we need to pay closer attention to improving regional connectivity i.e. air and water transport, e-commerce, telecommunication and financial integration.

The region must commit and work to make it easier, faster and cheaper to do business in the region

- What do you consider as the achievements of the chamber since you were sworn in last June?

Jane Wangui, Dagoretti.

With the support of my team, we have managed to project the image of KNCCI through improving our relationship with national government with key ministries and state government agencies, development partners and other organizations.

Through our economic diplomacy initiatives, we have supported international trade and attracted foreign direct investments, developed new markets abroad for export and development. Last year, I led successful trade missions to Russia, Japan, France and UK to promote bilateral cooperation just to mention a few.

The chamber has also partnered with the Ministry of Gender and Youth Affairs to whip special groups to take part in the 30 per cent government tenders to enable them unlock access of over Sh300billion meant for youths, women and people with disability under the Access to Government Procurement Opportunities (Agpo) programme.

His Excellency President Uhuru Kenyatta who has been our key supporter consequently ordered governments to pay off their debts to suppliers. Their lack of payment contributed to unemployment and damaged the economy.

- There has been hue and cry over rental issues between the landlords and tenants due to the current economic situation. What is your take as the leader of the private sector in the country?

Caleb Osinya, Mombasa

We are living in extraordinary times faced with a health crisis. As much as it is prudent to cushion the vulnerable, we also have a cardinal responsibility to protect businesses and investments. I would encourage the landlords and tenants to have personal engagement to deliberate on the rental payment terms. This is crucial because some of these investments are tied to financial obligations from bank facilities payable monthly. As a chamber, our position and input to the Pandemic Response and Management Bill, 2020 advocates for a negotiated approach between the landlord and the tenant. No one should be compelled to exempt charges in a blanket manner.

- How do businesses benefit by becoming members of KNCCI? Are there categories of membership?

Githuku Mungai, Nairobi

The benefits of joining the chamber are many just to mention a few. For instance, KNCCI has many business development initiatives such as trade facilitation, advocacy, networking opportunities, market intelligence and information sharing, finance and technical support services, trade and investment information dissemination, representation in key government initiatives on trade and investment at national, county level and globally. We also get markets for our members for their products and services both locally and abroad.

- What areas is the chamber working on to keep the mitumba clothes importers in business more so during this COVID-19 period now that the country banned its importation?

Shem Onderi, Kisii

The temporary suspension of the importation of second-hand clothes was imposed as a measure to stop the spread of the Covid-19 disease. At the same time, this creates new investment opportunities in other business sectors to invest more in local production under the ‘Buy Kenya Build Kenya’ programme.

Leave A Comment